A step-by-step guide for buying a house

Guide for buying a house 1. Understand why you want to buy a house Purchasing a home is a major decision that shouldn’t be taken lightly. If you’re not clear on why you want to buying a house, you could end up regretting your choice. Define your personal and financial goals. “Buyers should think about […]

How to buy a house in 2023

Buy a house can be an exciting and emotional process. Before starting your home search, you’ll want to understand the ins and outs of homebuying. This will empower you to make decisions that are the best for your family — and your wallet. What to consider Is now a good time to buy a house? […]

The Credit Repair System

The Credit Repair System has tools available that help many debtors find relief. A credit repair system is the step to recovering from debts while getting back on your feet again. If you have bad credit, you already know how difficult it is to reestablish respect in society. Struggling down many roads, I know you […]

Minimum credit score to get a mortgage

Minimum credit score to get a mortgage? There is no credit score threshold that will definitely disqualify you from getting a mortgage, but the lower your score; the harder it will be to find a lender to approve you for a loan. For conventional conforming loans, a 620 credit score is typically the minimum for […]

Solutions to build your credit

There are always solutions when it comes to repairing your credit. We sometimes go through problems in life that make our life hard to manage. Sometimes we simply have to skip ahead to get ahead. If you have late bills and see that you can’t meet these expectations be sure to make contact with your […]

Identity theft victims

Identity theft victims are those people who lose simply because someone has stolen their identity and run up their bills. If you are a victim of Identity Theft you are well aware of how difficult it can be to get back on your feet again. Identity Theft victims often have to go through a series […]

How to improve your credit with 9 ways

How to improve your credit with 9 ways. If your credit score is lower than you’d like, there may be fast ways to bring it up. Depending on what’s holding it down, you may be able to tack on as many as 100 points relatively quickly. Scores in the “fair” and “bad” areas of the […]

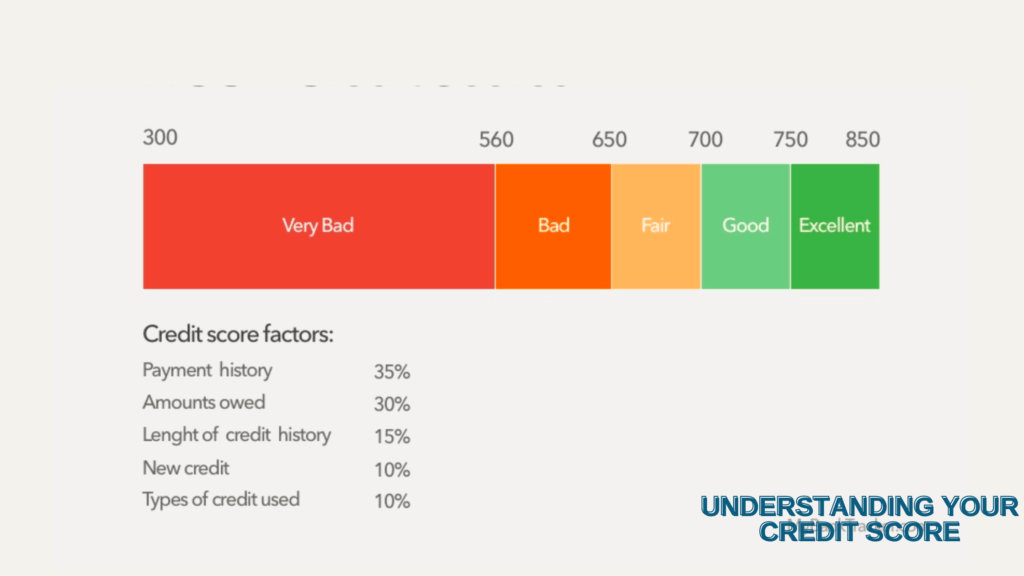

Understanding your credit score

Generally speaking, understanding your credit score to 690 to 719 is a good credit score on the commonly used 300-850 credit score range. Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair. Scores below 630 fall into the bad credit range. FICO, the most widely known credit scoring system, […]

Credit repair and credit report do it by yourself

Credit repair and credit report do it by yourself. Many of us believe that it is only through an agency that we could have any hope of repairing our credit. Rest assured that this is not true. It could cost you more money and time to arrange through an agency than it would to just […]

Credit repair and Collection agencies

Credit repair and collection agencies go hand in hand since one is out to get the other. In other words, we sometimes run from our debts taking advantage of a kind gesture. Collection agencies are not as kind as the lenders so, therefore, be a warning…the collection agencies are on the loose. Understand how collection […]