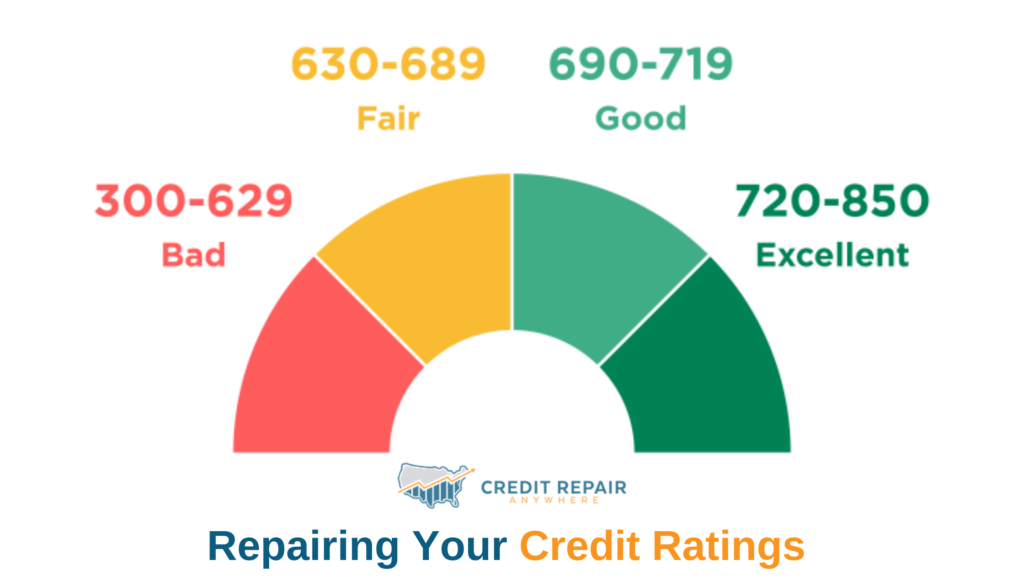

Repairing Your Credit Ratings

Is your goal to repair your credit rating? To repairing your credit ratings you may want to consider many factors before getting started on building your credit. Credit is good in many ways, and bad in some ways. Credit puts stress on us simply because we have to maintain a rating to get the respect […]

Understanding Credit Files

Understanding your credit files to repair your credit If you are in debt and nagged daily by creditors you might want to understand your credit files to repair your credit. If you are delinquent in payments your credit score is affected, and often you can’t get a loan. There are exceptions but if you can […]

Building Credit and Stopping Creditors

Building your credit is a sure-fire solution for stopping creditors and collection agencies from nagging you every day. If you are attempting to reestablish your status in life, you must realize there is a bumpy road ahead. Creditors are people you owe and if you do not pay, the creditors will go to lengths to […]

Caution When Building Your Credit

Building credit can be a very exciting thing. Avenues of great opportunities are available if you do it right. It is important to avoid scammers that claim to offer you a debt solution in little or no time at all. Many scammers on the market today are taking advantage of people in disarray. Do not […]

Credit Report Building Ideas and Strategies

You have delinquent credit and are married, you might want to build your credit report in your name instead of using your spouse. Somebody has to have stability. Also if you are divorced and all the credit cards of credit information are in your spouse’s name you will need to reestablish your credit in your […]

Restoring Credit is Essential for surviving

Restoring Credit is Essential for surviving in today’s time. Today’s barter is moving back to the system as many people including business owners find it to be a solution for getting out of debt or expanding their company. This might sound crazy, but if you think about it you can find a way to make […]

Tips to repair your credit without interruptions

Tips to repair your credit after repeated interruptions is a constant headache we all want to avoid. Many sources will take full advantage of you when the opportunity arises. If you feel bad simply because you can’t meet your bills’ expectations at the moment they arrive, then you are not alone. The fact is, even […]

Payday Loans, if you avoid them better

Payday Loans help if you are trying to make ends meet and have past due bills; piling up the last resource is taking out a payday loan to pay your dues. There are many sources available today that offer payday advances. The loans are issued after you show proof of banking account, Social Security, Driver […]

Fix your credit reports, to avoid declines

Fix your credit reports, to avoid declines in your credit applications and avoid the famous phrase: – Sorry, you are declined… Have you ever heard this before when you went to apply for a loan or a credit card? If you have, this means that your credit files have some negative reports and it is […]

Avoiding Complications in the mortgage loans

Avoiding complications in the mortgage loans if you want to repair your credit is almost important as getting out of debt. When we have bills that were neglected simply because we didn’t have the money to pay the bills, or else we purchased items instead of paying the bills, we are in debt. If you […]