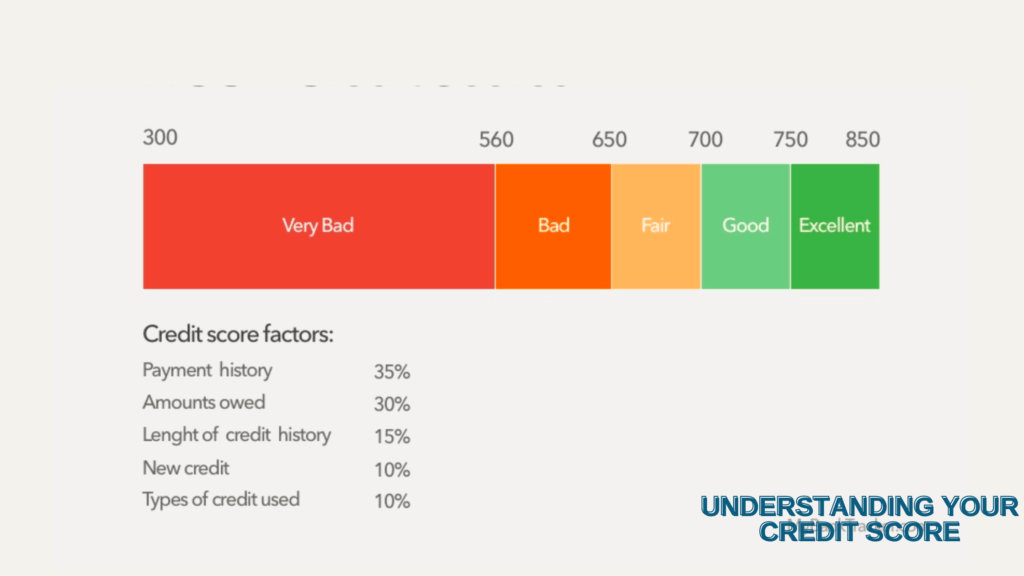

Understanding your credit score

Generally speaking, understanding your credit score to 690 to 719 is a good credit score on the commonly used 300-850 credit score range. Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair. Scores below 630 fall into the bad credit range. FICO, the most widely known credit scoring system, […]

Credit repair and credit report do it by yourself

Credit repair and credit report do it by yourself. Many of us believe that it is only through an agency that we could have any hope of repairing our credit. Rest assured that this is not true. It could cost you more money and time to arrange through an agency than it would to just […]

The minimum credit score you need to buy a car

The minimum credit score you need to buy a car is a huge financial step, and knowing your credit score can help you enter the buying process on strong footing. A second quarter 2022 report released in August by credit bureau Experian shows average credit scores of people financing cars rose slightly from a year […]

Where to Get Credit Resources?

If you are having problems with credit you might want to surf the market for resources that can help you find a way out of debt. The many resources available do not include the many spammers that tell you in three minutes we can get you out of debt. The scores of resources that offer […]

Credit repair and Collection agencies

Credit repair and collection agencies go hand in hand since one is out to get the other. In other words, we sometimes run from our debts taking advantage of a kind gesture. Collection agencies are not as kind as the lenders so, therefore, be a warning…the collection agencies are on the loose. Understand how collection […]

Importance of your credit score for loans

Why your credit score matters to loans Importance of your credit score for loans for your mortgage, Your credit score helps lenders determine your ability or inability to repay the mortgage (and, subsequently, their risk). Lenders also examine your debt-to-income ratio (DTI), the percentage of monthly debt obligations relative to how much income you bring […]

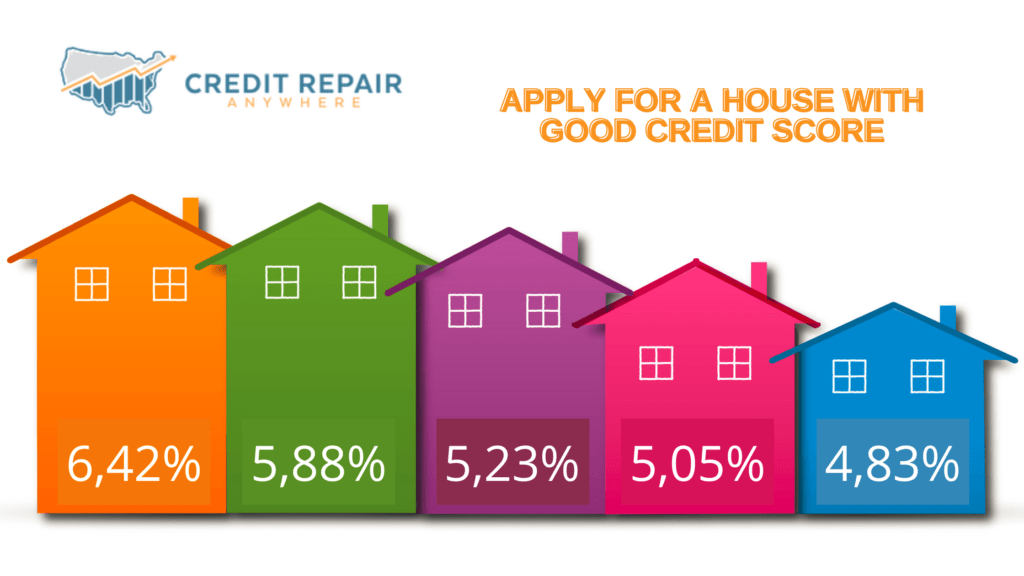

Apply for a house with good credit score

Strictly speaking, you don’t need a credit score to buy a house. If you’re paying cash, no one necessarily cares if you have good credit. However, if — like most aspiring American homeowners — you’ll need financing, then a credit score is a concern. Your credit score is one of the most important factors lenders […]

Avoid going to court paying debts

If you ever entered a courtroom, you know that the stress elevates; even if you are in the room for someone else. Courts are an automatic source of lifting stress. Moreover, to avoid the courts means we have to abide by laws and pay our debts. If you have taken out a home mortgage, car […]

Credit score error can harm housing buyers

Equifax – one of the big three U.S. credit scorers – says a computer coding error changed credit scores as much as 25 points, up or down. Between March 17 and April 6 NEW YORK – Equifax, one of the three major credit bureaus, announced that a computer coding error resulted in the miscalculation of credit […]

Cost of Fair and Excellent Credit score

A borrower with a “fair” credit score could pay $103,626 more over the life of a 30-year loan compared to a similar borrower with an “excellent” score Potential buyers considering a home buy one day usually receive the same advice: Try to improve your credit score. For lower credit scores, home buying is out of […]