Does Applying for Credit Cards Hurt Your Credit?

Does Applying for credit cards can damage your credit scores? Just a single application may shave a few points off your score. But multiple applications for cards in a short span could suggest you are a riskier borrower than someone who applies less often. This can be especially frustrating if you are trying to build […]

How to buy a house in 2023

Buy a house can be an exciting and emotional process. Before starting your home search, you’ll want to understand the ins and outs of homebuying. This will empower you to make decisions that are the best for your family — and your wallet. What to consider Is now a good time to buy a house? […]

5 Tips for lowering your credit utilization

Lowering your credit utilization is simply how much of your available credit you use, expressed as a percentage. It is the total of balances on all your credit cards divided by the total of all your credit limits. This number plays a big factor in your credit score — the less available credit you use, […]

The Credit Repair System

The Credit Repair System has tools available that help many debtors find relief. A credit repair system is the step to recovering from debts while getting back on your feet again. If you have bad credit, you already know how difficult it is to reestablish respect in society. Struggling down many roads, I know you […]

Solutions to build your credit

There are always solutions when it comes to repairing your credit. We sometimes go through problems in life that make our life hard to manage. Sometimes we simply have to skip ahead to get ahead. If you have late bills and see that you can’t meet these expectations be sure to make contact with your […]

Identity theft victims

Identity theft victims are those people who lose simply because someone has stolen their identity and run up their bills. If you are a victim of Identity Theft you are well aware of how difficult it can be to get back on your feet again. Identity Theft victims often have to go through a series […]

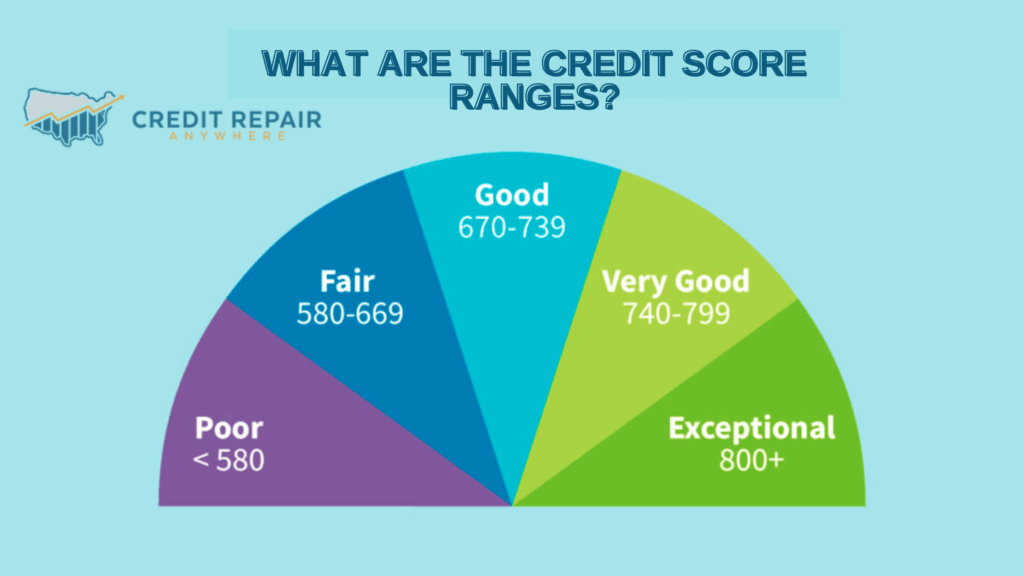

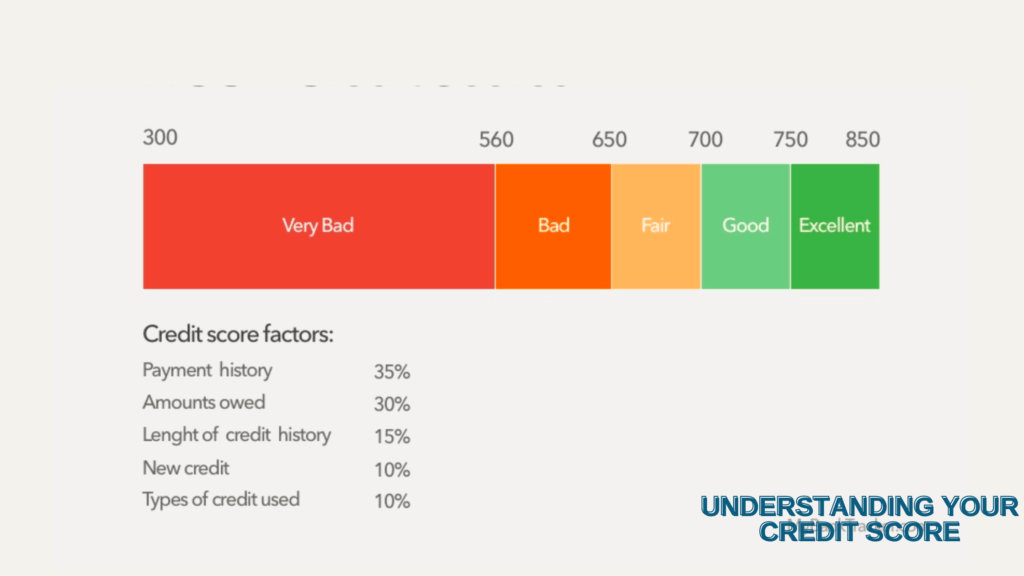

What Are the Credit Score Ranges?

Credit score ranges influence many aspects of your life: whether you get a loan or credit card, what interest rate you pay, sometimes whether you get an apartment you want. A higher credit score can give you access to more credit products — and at lower interest rates. Borrowers with scores above 750 or so […]

How to improve your credit with 9 ways

How to improve your credit with 9 ways. If your credit score is lower than you’d like, there may be fast ways to bring it up. Depending on what’s holding it down, you may be able to tack on as many as 100 points relatively quickly. Scores in the “fair” and “bad” areas of the […]

Understanding your credit score

Generally speaking, understanding your credit score to 690 to 719 is a good credit score on the commonly used 300-850 credit score range. Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair. Scores below 630 fall into the bad credit range. FICO, the most widely known credit scoring system, […]

The minimum credit score you need to buy a car

The minimum credit score you need to buy a car is a huge financial step, and knowing your credit score can help you enter the buying process on strong footing. A second quarter 2022 report released in August by credit bureau Experian shows average credit scores of people financing cars rose slightly from a year […]