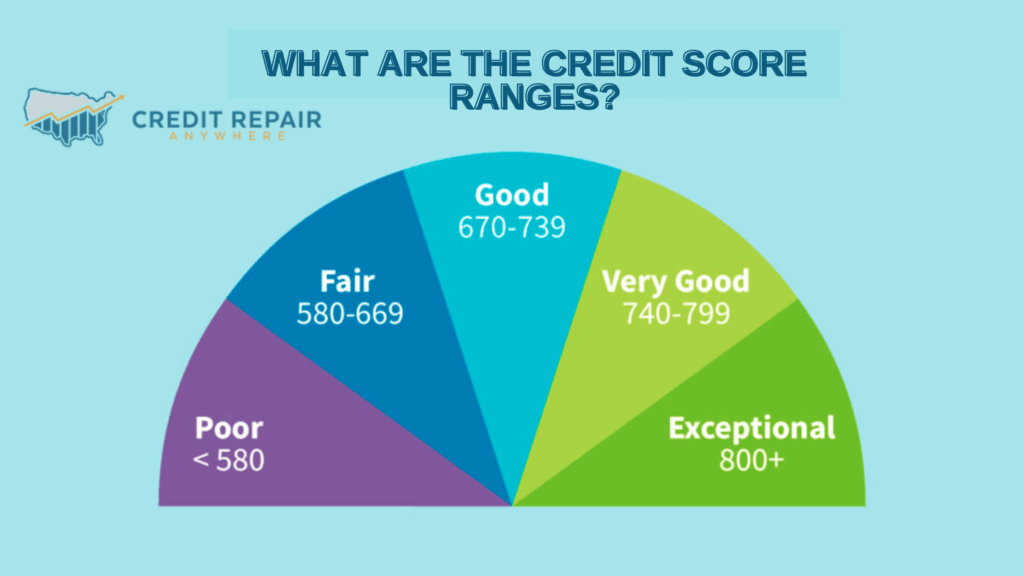

What Are the Credit Score Ranges?

Credit score ranges influence many aspects of your life: whether you get a loan or credit card, what interest rate you pay, sometimes whether you get an apartment you want. A higher credit score can give you access to more credit products — and at lower interest rates. Borrowers with scores above 750 or so […]

Defaults on your credit report

If you have defaulted on your credit record; it is possible to have some of them removed. Defaults are non-payments recorded on your credit files. When a person is in default, they are subjected to lawsuits, liens, judgments; and other complicated situations. If you are a student struggling to pay student loans, a renter struggling […]

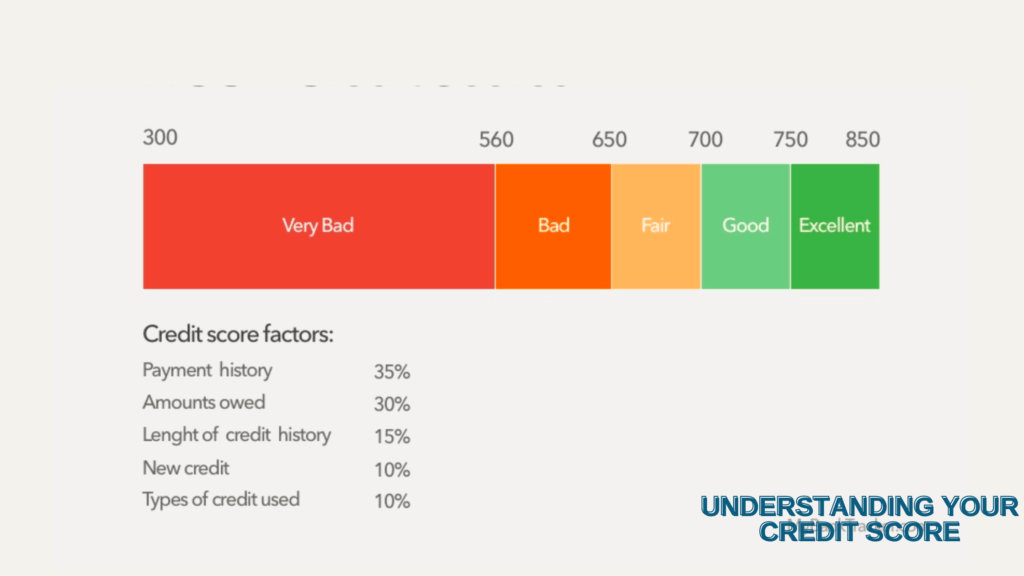

Understanding your credit score

Generally speaking, understanding your credit score to 690 to 719 is a good credit score on the commonly used 300-850 credit score range. Scores 720 and above are considered excellent, while scores 630 to 689 are considered fair. Scores below 630 fall into the bad credit range. FICO, the most widely known credit scoring system, […]

The minimum credit score you need to buy a car

The minimum credit score you need to buy a car is a huge financial step, and knowing your credit score can help you enter the buying process on strong footing. A second quarter 2022 report released in August by credit bureau Experian shows average credit scores of people financing cars rose slightly from a year […]

Where to Get Credit Resources?

If you are having problems with credit you might want to surf the market for resources that can help you find a way out of debt. The many resources available do not include the many spammers that tell you in three minutes we can get you out of debt. The scores of resources that offer […]

Credit repair and Collection agencies

Credit repair and collection agencies go hand in hand since one is out to get the other. In other words, we sometimes run from our debts taking advantage of a kind gesture. Collection agencies are not as kind as the lenders so, therefore, be a warning…the collection agencies are on the loose. Understand how collection […]

Avoid going to court paying debts

If you ever entered a courtroom, you know that the stress elevates; even if you are in the room for someone else. Courts are an automatic source of lifting stress. Moreover, to avoid the courts means we have to abide by laws and pay our debts. If you have taken out a home mortgage, car […]

Credit score error can harm housing buyers

Equifax – one of the big three U.S. credit scorers – says a computer coding error changed credit scores as much as 25 points, up or down. Between March 17 and April 6 NEW YORK – Equifax, one of the three major credit bureaus, announced that a computer coding error resulted in the miscalculation of credit […]

Cost of Fair and Excellent Credit score

A borrower with a “fair” credit score could pay $103,626 more over the life of a 30-year loan compared to a similar borrower with an “excellent” score Potential buyers considering a home buy one day usually receive the same advice: Try to improve your credit score. For lower credit scores, home buying is out of […]

Creditors Calling its Time to Repair your Credit

When the creditors are calling the phone off the wall you know it is time to repair your credit. The United States alone has millions of individuals and families struggling to find a way out of debt. This is why when you go online you see thousands of websites that say they have the solution […]